By Tony Christian

A number of factors make the technical market an exciting area for investors. However, before we discuss those factors we should set the foundation for that discussion by defining the scope and the size of the technical applications market. The term technical applications covers a range of applications used by engineers and designers across all of the manufacturing industries—architecture, construction, utilities, and other sectors where computer-based design aids provide valuable, if not essential, capabilities. The range of applications includes computer-aided design, manufacturing, and engineering and product lifecycle management (PLM) in manufacturing industries; building information management (BIM) and mechanical, electrical, and plumbing engineering in architecture, technical, and construction (AEC); and geographic information systems for geospatial applications. There are also the applications such as visual effects used by creative professionals for industrial and other design tasks. In addition, the trend towards smart devices expands the scope of technical applications to include new areas, notably the tools used for software and semiconductor development.

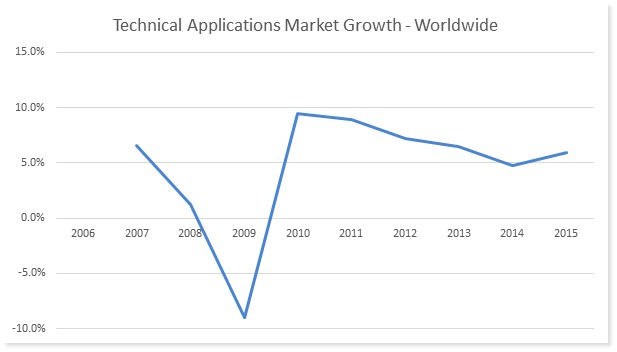

The core technical applications market, including tools for lifecycle management of embedded software, is around $20 billion. On the following page, Figure 1 shows the year-on-year growth of the market worldwide since 2006.

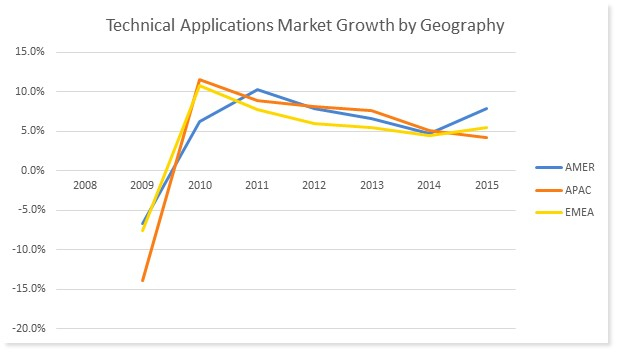

The downturn in 2009 following the 2008 crash is clear, but since then the market has returned to consistent growth, although that growth has varied slightly by region. Figure 2 shows growth since 2008 by geography, and Figure 3 displays growth since 2008 by application segment.

A Good Investment Opportunity

From an investment point of view, two major factors make the technical software market attractive—growth and exit opportunity. A key attribute of technical applications that drives continued market growth is a strong case for adoption irrespective of the circumstances of the user organization, since the benefits range from reduced costs and streamlined product development processes to better designs, the ability handle more complex products, and integrated PLM. In addition, the market continues to grow in scope as technical applications are adopted in ever-increasing areas of activity. In manufacturing industries, from their origins in the product design and development phases of a product’s life, technical applications are being exploited right across the product lifecycle, supporting new ways of providing after-sale maintenance and support and closing the loop between innovation and field use. With the increasing use of smart networks for managing production and even in the design and development phases, they are used to support new collaborative approaches and processes. In the AEC industries, the growing use of BIM to integrate not only design but also facility operation across its lifetime is generating numerous new application and integration technology opportunities. This market dynamism, together with the nature and structure of the technical software market, means that excellent exit opportunities exist for the right business. The major players now primarily seek competitive advantage by breadth of integrated solution portfolio than by focused product capabilities. The sheer range and number of the applications required to achieve this makes it impossible for them to develop everything in house. Consequently, the recent history of the market has featured a string of strategic technology acquisitions by the dominant companies.

This market dynamism, together with the nature and structure of the technical software market, means that excellent exit opportunities exist for the right business. The major players now primarily seek competitive advantage by breadth of integrated solution portfolio than by focused product capabilities. The sheer range and number of the applications required to achieve this makes it impossible for them to develop everything in house. Consequently, the recent history of the market has featured a string of strategic technology acquisitions by the dominant companies.

Assessing Potential Opportunities

While the technical applications market offers great opportunities for investors, identifying and analyzing those opportunities requires a high level of rigor. The market is complex, spanning almost all parts of the world and covering a huge number of industries. It includes a number of products for a range of activities. Like most markets, it has its mature areas, where growth is modest but steady and entry is difficult; its growth hot spots; and its white spaces. Most companies in the space have a number of products, several target industries, and multiple geographic markets. Furthermore, many customers have made substantial investments in technical application infrastructure, with well-established incumbent product sets supporting product development workflows. This combination of market complexity and maturity means that evaluating investment opportunities is a multi-dimensional task, requiring many perspectives. Alongside the analysis of a company’s financial position and the capabilities and experience of the leadership team, assessment of its future prospects requires careful consideration of its technology in the context of market trends and competitor capabilities, as well as a host of other factors including market size, penetration, and growth outlook for each of the industries; regions and segments to be addressed; channels to market; and pricing and licensing models.

This combination of market complexity and maturity means that evaluating investment opportunities is a multi-dimensional task, requiring many perspectives. Alongside the analysis of a company’s financial position and the capabilities and experience of the leadership team, assessment of its future prospects requires careful consideration of its technology in the context of market trends and competitor capabilities, as well as a host of other factors including market size, penetration, and growth outlook for each of the industries; regions and segments to be addressed; channels to market; and pricing and licensing models.

Evaluating Investments

The starting point for evaluating investment opportunities must be a comprehensive market landscape that brings together all of the relevant factors to be considered for the area of the market into which the opportunity falls. The market landscape should therefore cover overall market structure and the business models adopted for the chosen market sector, and trends in both of these areas. It should also consider commercial frameworks in the sector, including pricing and licensing; and quantitative market information, including size and predicted growth for the segment(s) of interest. Such a market landscape can be tuned according the stage of the investment analysis—for example, if a specific target company has been identified, the attributes of that target company and profiles of likely competitors can be incorporated into the picture. dps

Tony Christian is director for industry analyst and market consulting firm, Cambashi. He offers a wide-ranging experience in engineering, manufacturing, energy, and IT. His subsequent roles included divisional head of the IT subsidiary of a major international engineering and construction company and leadership of teams developing and implementing manufacturing control systems at British Aerospace. More recently, Christian was a director of the U.K. Consulting and Systems Integration Division of Computer Sciences Corporation and then services and technology director at AVEVA Group plc consulting and managed services business.

Jul2015, DPS Magazine