by Cassandra Balentine

Transactional documents are essential communications between customer and provider. These are complex documents riddled with secure information that must get to the right recipient on time, often in electronic and print versions.

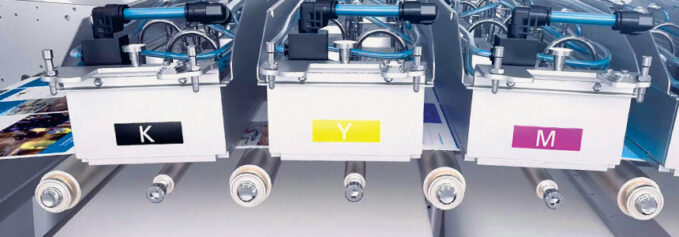

Above: Canon’s ColorStream 8000 series offers native 1,200 dpi resolution at print speeds of up to 525 feet per minute.

Traditional print has evolved to include multiple channels, making print just one of many options for assessing information. “The push has been for electronic delivery and the focus is around customer satisfaction/retention, along with a reduction in rising postage, materials, and labor costs,” comments Kemal Carr, president, Madison Advisors.

Marc Mascara, manager, professional services, production print solutions, Canon Solutions America, Inc., adds that the transactional print market is quite complex in its nuance as it flows through each and every vertical. “The divergence of polarization between what consumers desire and what the enterprise strives for continues to drive innovation.”

It is evident that consumers have become more critical regarding their preferred communications channels. “For instance, the younger generation prefers digital channels for paying bills and marketing, but research shows they continue to gravitate to paper mail for their statements, which in itself is a sea change in how the younger generation is viewing things,” shares Mascara.

This is in contrast to how the enterprise looks at cost reduction methods and how best to implement their paper suppression programs. The end result is poor customer experience and diminishing customer satisfaction. “Just this example has had a marked impact on how transactional print has accelerated its transition into a true multichannel or optichannel environment, that can answer the call to provide customers with the communication channel they desire and the innovations along with smart print manufacturing answer the call for faster, better, cheaper. Advancements in artificial intelligence (AI) and innovations that help drive optichannel workflow bring digital and print communication into a more symbiotic relationship,” says Mascara.

Industry Evolution

Transactional documents constantly evolve, overshadowed by more ‘sexy’ print applications like labels, packages, signage, and even books.

The continued move to inkjet, in both cutsheet and roll-sheet configurations, is a noticeable trend. “Multiple print manufacturers are represented in almost every environment we are installed in,” notes Margaret Curry, national manager, PPS and strategic accounts, RISO.

Further, while black-only toner devices experience a drop in volume, color inkjet picks up transactional volumes, she adds.

“The biggest change in the transactional space is the shift to color print versus B&W, allowing invoices and statements to act as marketing/communication tools—not just documents,” agrees Brad Turner, VP, transformation, BelWo, Inc.

“Looking back five years ago, there was talk in the industry around the benefits of full-color inkjet and white paper factories, but at that time only a few printers actually made the move to adopt it. Fast forward to now, all of our customers use full-color inkjet in some fashion,” offers Ryan Semanchik, president, Transformations, Inc.

This evolution goes beyond the equipment required and comes with software solutions that offer optimized PDF output for size control and speed efficiency along with improved color management.

Patrick Kehoe, EVP, product management, Messagepoint, says the pandemic accelerated the push to reduce print volumes of transactional communications in favor of electronically distributed communications, in many cases out of necessity rather than just the desire to align with customer preferences.

Statement producing companies have, for years, conducted ongoing campaigns to get recipients to switch from physical mail to electronic statement delivery, admits Aron Allenson, product manager, high-speed inkjet, Screen USA. He says these campaigns are primarily instituted for statement production cost savings through the elimination of print and postage. “The result is that large percentages of people have opted out of physical mail. This has caused statement producer volumes to go down. In some cases this has driven plant closures and consolidations. At the same time, there have been mixed results with transpromo advertising within statementing. The primary reason for mixed results is the groups responsible for statements don’t have the bandwidth or expertise to effectively utilize and in some cases acquire data to relatively market their customers.”

Automation is essential to the efficiency and effectiveness of the transactional document lifecycle. Andrew Gunn, global director, production value proposition and product lifecycle; Billy Stojanovski, global product marketing manager, global brand and strategy; and Moisha Clark, production lifecycle iGen and Baltoro HF Inkjet Presses; Xerox Corporation, say while the term digital transformation is relatively new in the transactional print market, a streamlining evolution has been in the making for the last several years and workflow is one key component.

“There are lots of inefficient manual processes and steps in prepress using legacy file formats. The notion of automation hasn’t always been a focus, but when you observe prepress processes in terms of hours to complete a task, it’s a real eye-opening experience. Using the same files, workflow automation can reduce that time down to minutes or seconds. We understand workforce constraints put a burden on printers today and workflow automation can free up resources for more important tasks,” they comment.

Adding pressure, service level agreements (SLAs) have continued to shrink in the transactional print service provider market. “Customers want providers to produce transactional print faster—sometimes within 24 or even 12 hours. The shorter the SLA, the less a transactional printer can afford for something to go wrong. This also drives them to look for faster processes and print and finishing devices to speed up the production of the work. In short, workflow and process optimization and automation take center stage in production print planning and execution,” adds Mary Ann Rowan, chief experience officer, Solimar Systems.

“Digital printing technology has enabled transactional printers to offer more customized and personalized products, while also reducing costs. Additionally, automation processes improve efficiency and reduce turnaround time. Companies increasingly use digital data and analytics to better understand their customers and their preferences, allowing transactional printers to tailor their services to meet customer needs. Web to print has also become more popular, allowing customers to create, submit, and track their transactions online,” adds Avi Greenfield, VP, product management, CXM, Quadient.

Bryan Ten Broek, VP of business development, Nordis Technologies, feels that personalized communications are increasingly important for attracting and retaining customers. Just as companies are expected to deliver communications based on channel preferences, consumers increasingly want tailored content in communications. They expect a business to know their existing relationships, services, and products as well as customize offers, payment and financing options, information, news, and other messaging to their circumstances.

In the past five years, Johan Laurent, director of business operations, Standard Finishing Systems, noticed increased demand by the financial sector for visually engaging, personalized statements that better appeal to customers and meet regulatory requirements. This demand fueled the transactional market’s switch to digital print, particularly in high-volume shops, to allow for easier data management from prepress through post press.

“Customer expectations have evolved significantly in the last five years, changing the temperature of the conversation. Today, customer preference is dictating what companies offer because customers want to choose their method of communication. They seek vendors that offer multiple channels of communication, whether it be print, email, take online payments, send out text messages, or all the above. It is a multi-generational demographic of buyers that want options,” says Semanchik.

Ideally, Allenson says there would be a push for better usage of available data for transpromo marketing. “People don’t mind getting marketed to as long as the marketing is relevant. Often the companies sending out statements have the best access to that data and the question is, will they see the value of it and then devote the resources to executing it well. If they do, this could change the nature of transactional printing from a simple relaying of facts to marketing quality printing.”

“Companies leverage omni-channel, customer communications management (CCM) platforms to deliver better customer experiences. They respond to growing consumer expectations for digital and mobile options by adding email and text messaging, which provides greater choice and convenience,” offers Ten Broek.

It’s essential to give consumers with access to the information they want on the channel they prefer, whenever they want it. “As a result, all aspects of production print and customer CCM have evolved to incorporate new channels. And while print remains important, it is just one aspect of a broader communication experience that companies must provide. This includes ensuring that all communications are not only accessible, but useable on various mobile and web platforms,” states Ernie Crawford, president/CEO, Crawford Technologies.

However, it is important to note that the expansion of channels and devices that people use to access information creates new data security challenges for communication providers. “They implement stronger security measures to ensure confidential information is protected and avoid the risk of a security breach, while ensuring they can provide relevant communication when and where it is needed,” adds Crawford.

Rowan suggests that both security and shrinking SLA timelines create a need for continued evolution in the transactional print market. “Beginning with security, as ransom attacks and other security vulnerabilities have increased, the need to protect both customer and company data has become crucial. To do this, transactional customers are in technology, people, and vendor partnerships. Those investments increase the costs of producing transactional print in a very tight market.”

Working Through Challenges

Transactional documents often take a lot of coordination to be not only informative, but effective communication pieces. Common challenges transactional providers face involve security, staffing, service options, disaster recovery, and supply chain issues.

Carr feels that one of the biggest challenges data center transactional printers face today is that their cost model is in direct conflict with the organization’s cost strategies, which is a reduction in postage spend and operational expenditure that can only be met with the migration to digital. He sees significant initiatives within organizations to move customers to digital delivery, which reallocates budget away from operational advancements.

“Look at an average bill, statement, or letter, it’s an opportunity to look at the information contained in these and explore if there is an opportunity to provide more information on companion products or services that they can offer,” note Gunn, Stojanovski, and Clark. “In other cases, just the move from monochrome to color might speed up the time it takes the consumer to pay. For that to happen the folks in the data center and print facility need to work together with their marketing departments and plan future steps together.”

Matt Mahoney, EVP, sales and marketing, Racami, says challenges come when data centers/transactional providers own too much technology that doesn’t work well together, creating inefficiencies and quality problems

Further, the cost of compliance, lack of knowledge of digital communications and complex multi-channel workflows, the cost of insurance to protect against cyber attacks and errors, and dealing with aging technology—both software and hardware—that has to be replaced are other issues,notes Mahoney.

Ten Broek agrees, adding that the demand for easily accessible production and performance data from transactional printers and communications providers to improve business decision-making continues to rise.

This comes when it is increasingly important for organizations to demonstrate competence in both print and digital output. “The electronic output experts come from the digital space and use digital tools. Print experts steadily evolve print capabilities in their area. As the two come together, it is difficult to get a team with expertise in both. Many organizations keep this separated for traditional reasons, but this strategy adds a lot of cost, introduces complexity, and creates opportunities for cross-channel inconsistencies,” shares Greenfield.

Declining volumes make it hard to justify in-house plants and operations. “As customers want more flexibility and agility in their operations overall and as they seek out efficiencies in managing both print and electronic communications, it is important for printers to adapt to offer the kinds of services that address those changing needs,” offers Kehoe.

Security considerations are constant. “Five years ago security was not the issue it is today. Now it is the first topic of conversation,” says Semanchik.

Compliance and data security are top of mind, especially now in our current environment with security concerns and regulations. “As outsourcing trends continue to rise in favor of print providers, businesses look less towards providers with the lowest cost and more towards providers that have a proven track record with advanced delivery solutions, including data security,” comments Mascara.

The stakes are high when handling sensitive documents. Industries such as insurance, financial services, and healthcare must navigate an ever-changing regulatory landscape with increasing penalties and risk; penalties that could ultimately run them out of business if not in compliance, explains Semanchik.

“Security and the tracking of documents is increasingly important to make sure data stays secure and you can tell a customer where it is at all times. Having the right certifications is also critical and requires a robust data center that can pass audits. At the very minimum, a data center needs to be certified in Systems and Organization Controls 2 (SOC 2). Compliance with SOC 2 requirements indicates that an organization maintains a high level of information security and ensures sensitive information is handled correctly,” explains Turner.

“Stricter data regulations are a challenge as transactional print providers need data management and integrity solutions that protect sensitive customer data,” agrees Laurent.

Whether it is rising costs or security, data centers/transactional printers face a number of significant challenges. “Organizations continue to manage increasing volumes of confidential data that put them at risk for a security breach. They need to ensure they have the right processes, training, and tools in place not only to protect their customers’ data, but also their brands,” observes Crawford.

While economic conditions may seem challenging, there is no better time to invest in modern technology and tools to replace outdated systems. “This, combined with investments in staff training, will help an organization be in an optimal position to take advantage of new customer and market needs,” adds Crawford.

“Digital natives understand security concerns and identify with the trend back towards paper adoption,” suggests Mascara. “With that said, customers have digital fatigue, which is also nudging every age group of consumers to traditional mail/paper. So innovation is not static. Innovations in print will also continue. Just over the last three years we’ve seen innovations in inkjet technology and digital press capital expense, especially as smart print manufacturing helps drive the cost down for both manufacturers and print providers in terms of reduced labor costs. The negative for print, as everyone is aware, is the delivery cost associated with the mail stream.”

Looking Forward

It is easy to get caught up in the complications of things, but there is a lot of opportunity in the transactional print space.

Curry says this may come in the form of better inline finishing for inkjet presses, the ability to handle smaller volume jobs and reprints, or improved monitoring capabilities.

“Printed transactional documents might be declining in volume, but they aren’t going away any time soon. We see a huge opportunity for both in-house operations and service providers to step up and provide electronic distribution services,” says Kehoe.

Organizations look to these operations to provide the control and governance that are so important for these kinds of communications. “This doesn’t go away just because the communications are electronic, there is still a need for that kind of expertise, and many organizations are well suited to bring those capabilities together,” adds Kehoe.

He also points to the opportunity to help customers make printed communications work a little harder for them, thereby making your role more valuable.

Semanchik sees a the potential to increase competitiveness in the transactional market space by implementing technology that allows you to build more offerings into the system beyond just print and mail. “For example, adding the ability to do online payments to your offering is a great way to build additional revenue and foster more growth from current customers. Also, added value, such as stronger compliance solutions with extensive dashboarding, reporting, tracking, auditing features, and business intelligence providing full transparency throughout the document lifecycle can really help you excel against your competition rather than playing catch up.”

The goal is becoming a full-service provider and doing everything you possibly can for a customer, comments Turner. “To grow your business, find out what else you can do in addition to the transactional work for the customers you have. The more you are able to help support a customer’s business, the more you foster customer stickiness, meaning they are more likely to stay with you for a long time.”

Gunn, Stojanovski, and Clark believe the transition from B&W to color printing offers the biggest opportunities. “Our customers tell us they actually get paid back quicker or on time because their customers read color statements faster. In fact, color statements can increase payment response by up to 30 percent,” they offer.

Print to digital conversions using techniques like quick response (QR) codes is expected to continue for the coming years, according to Greenfield.

The continued migration to secure cloud workflow solutions helps alleviate staffing requirements around application onboarding time and cost, predicts Crawford. Additionally, the regulations related to accessible communications are growing and organizations that can provide accessible, digital, and print versions are going to see great growth in the coming years.

With the right technology and channels in place, Ten Broek says companies can shift focus to optimize omni-channel communications and find the right mix by segment and individual to deliver a superior personalized customer experience that drives engagement and loyalty. “AI-driven data analytics plays an important role in identifying that right mix and timing.”

Crawford believes the use of AI in providing data insights for the creation of personalized, relevant communications will be a significant opportunity for communication providers.

Carr sees the biggest opportunity in the next few years is the reduction in operational cost as a result of migration to digital delivery.

For printed documents, the new generation of automation is hitting the print market from both printers and print finishing suppliers, adds Laurent.

Transactional Trends

Transactional documents are necessary to communicate essential information between a business and customer. While digital delivery options continue to emerge, print is here to stay.

If we were asked to speculate on the future of transactional print a decade ago, the outlook might be bleak. But now, Mascara sees a flattening trend line. “Print is not going away, digital is not taking over. Both have been leveling off for the past few years. But keep in mind the curve that is flattening is in a different progression for each vertical. That’s why it’s important to keep an eye on innovation and customer communication preference. This is not a major resurgence of transactional print, but print is emerging as the enabler for digital communications. Following the pandemic, we see this acceleration of the trend of print as the first entry point to a customer, be it transpromo or QR codes on statements, enabling and driving the consumer to secure and relevant forms of communications,” he concludes.

Visit our webinar on this topic!

May2023, DPS Magazine